idaho estate tax exemption 2021

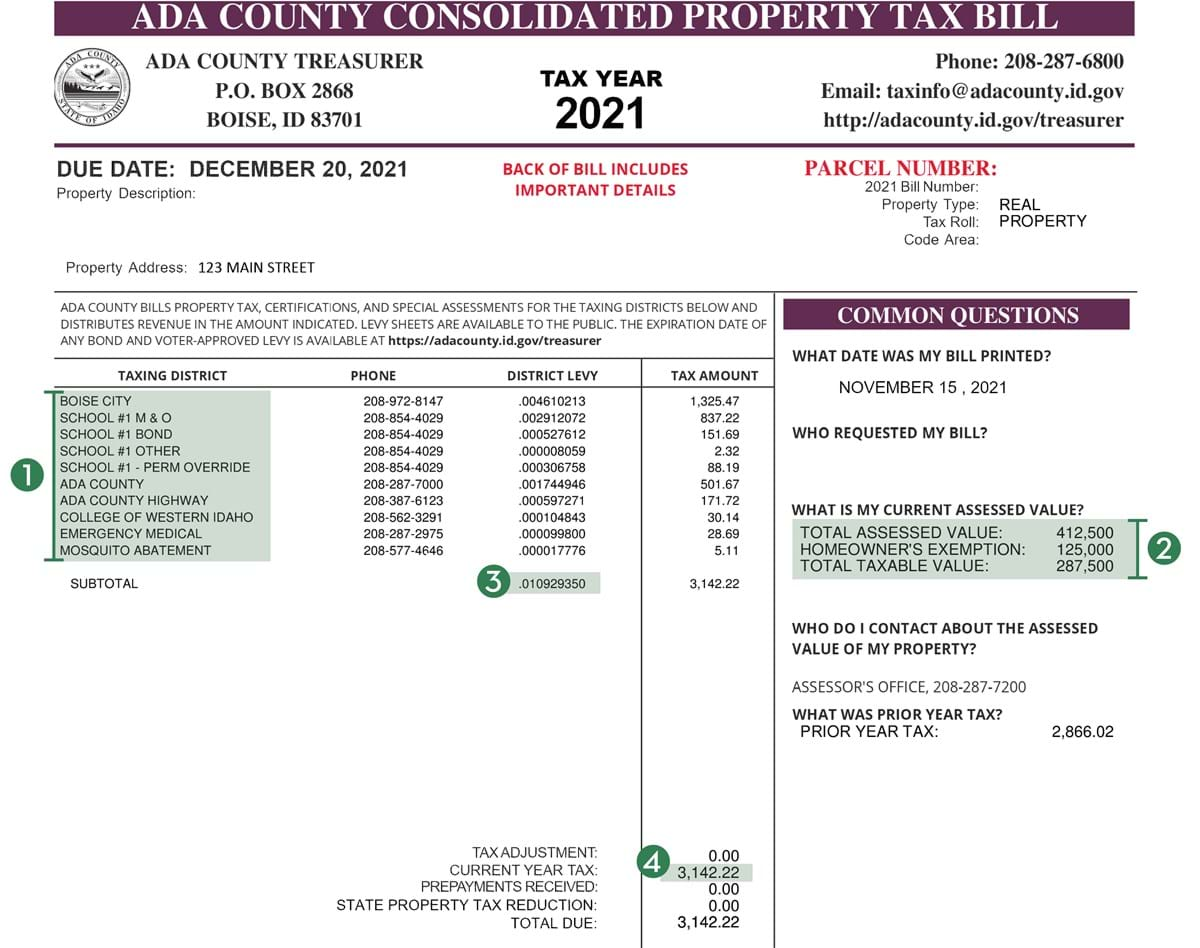

If youre a qualified Idaho homeowner you might be eligible for the Property Tax Reduction. 1 For each tax year the first one hundred twenty-five thousand dollars 125000 of the market value for assessment purposes of the homestead as that term is defined in section 63-701 Idaho Code or fifty percent 50 of the market value for assessment purposes of the homestead as that term is defined.

Post Falls Leaders Suggest Path Forward On Property Taxes Coeur D Alene Press

Idaho has no estate tax.

. The exemption allows for a. Available to residents of Idaho who own residential property in Idaho. Amending section 63-705 7 idaho code to revise provisions regarding property tax reduction in-8 come limitations and benefit amounts and to establish provisions for 9 referral of certain applicants to the property tax deferral program.

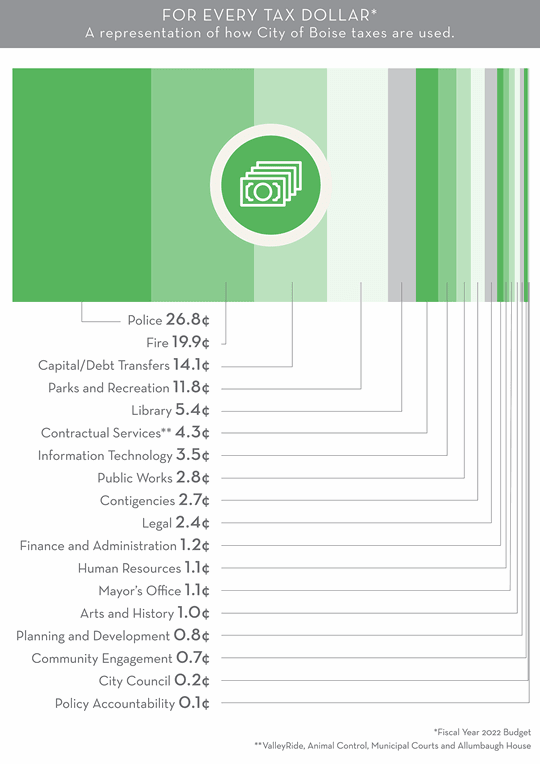

It also opposed to the recent increase in the homeowners exemption to 125000 because it shifted an estimated 30 million in taxes back on to commercial payers. You could reduce property taxes from 250 to 1500 on your home and up to one acre of land. Did you receive a Property Tax Reduction in 2021.

Find Out Which Idaho Property Tax Exemption You Qualify For. 6 certain business property tax exemptions. The status of each bill resolution proclamation and memorials listed on this page are updated when the offices of the Secretary of the Senate and the Chief Clerk of the House publish the un-official daily journals and should not be deemed official.

In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. This exemption allows the value of your residence and land up to one acre be exempted at 50 of the assessed value up to a maximum of 125000. If you have occupied a newly constructed home after the first of the year you must apply for the Homestead Exemption within 30 days of receiving a notice of assessment for the newly occupied dwelling for the exemption.

2022 Property Tax Reduction Program Brochure 12-30-2021. It also raises a property tax reduction for qualifying low-income seniors from 1320 to 1500. The maximum benefit for the Property Tax Reduction program has increased to 1500.

Read more about PTR in this brochure. During the waning days of the 2021 legislative session lawmakers altered the ability of municipalities to adjust their budgets based on new growth. House Bills 309 and 389 Effective January 1 2021.

The estate tax is commonly referred to as the death tax. It applies when a persons gross estate less deductions and qualified expenses is above a specified. As such there is no exemption applied to the assets of an estate.

For instance if the home and propertys assessed value is. Brad Little signed a property tax relief bill Wednesday that opponents describe as deeply flawed but supporters say is better than nothing. There is a maximum exemption of 100000.

The applicant need not re-apply unless there are changes in the residency. The Idaho Legislatures Property Taxes and Revenue Expenditures Study Committee which is a joint committee composed of six senators and seven representatives met Friday to discuss new proposals. The exemption affords homeowners a tax break of 50 of the houses value and up to one acre of land from property tax.

Connecticut continues to phase in an increase to its estate exemption planning to match the federal exemption by 2023. Most states do not impose an estate tax. 10 amending section 63-705a idaho code to revise provisions.

So now if a property were valued at 400000 the taxable value would be 275000 thanks to the new exemption amount. L L I certify that I am a citizen or legal permanent resident of the L United States OR I certify that I am in the United States legally. If youre a qualified Idaho homeowner you might be eligible for the Property Tax Reduction PTR program.

By KEITH RIDLER May 12 2021 GMT. Otto Kitsinger for Idaho Capital Sun Within a matter of hours members of the Idaho House of Representatives printed heard and sent a property tax bill to the House floor that increases the homeowners exemption from 100000 to 125000. Connecticuts estate tax will have a flat rate of 12 percent by 2023.

Federal and state tax. The bill raised the maximum exemption for the circuit breaker program from 1320 to 1500 but it also added an asset test for a claimants home. The homeowners exemption has increased to 125000.

Applying for an Idaho property tax exemption is one of the options for people who need to lower their property tax bills. The property applied for must be the primary residence of the applicant. Based on your income for 2021 the program could reduce property taxes on your home and.

However as the exemption increases the minimum tax rate also increases. The system itself is broken LeBeau said. A house for sale near the Boise Depot on March 20 2021.

The bill also increased the personal property tax exemption and made changes to the circuit breaker program which provides reduced property taxes to elderly disabled and widowed taxpayers. Apply for PTR through your county assessors office. The official bill actions are located in the final journal.

The following changes have been made to property tax relief programs. Program also known as the Circuit Breaker. 2021 Legislation by Bill Number.

His organization has long supported property tax cuts and an end to the personal property tax in Idaho. Idaho has no estate tax. To qualify for the current assessment year the property must have been purchased and residency.

Contact your county assessor for additional program information and an application. Idaho estate tax exemption. L Tax reduction not to exceed.

If your estate is large enough you still may have to worry about the federal estate tax though. Jim Rice is working with local assessors to develop county-specific exemption formula. The Republican governor expressed his own doubts in approving the legislation that was rushed through in the final days of the legislative session.

L Idaho grocery credit form 14. With an average urban tax rate of 132 and the rural rate of 089 Idaho is one of the most expensive states for homeowners. The measure raises the homeowners exemption from 100000 to 125000.

Kelcie Moseley-Morris - August 27 2021 345 pm. Businesses will also get a hefty break from this package on their personal property taxes. There is an 1170 million million exemption for the federal estate tax for deaths in 2021 increasing to 1206 million in 2022.

The bill would increase the tax exemption for businesses buying inventory machinery and equipment from 100000 to 250000. It will also fully exempt all personal property defined as transient personal property starting at the beginning of 2022. Only 12 states assess a tax.

It includes several other provisions that would provide tax relief to. ClaimantSpouse I certify that my Social Security number and birthdate are correct. BOISE Idaho AP Idaho Gov.

Property-tax relief program modified. Property exempt from taxation Homestead. Additionally they increased the maximum homeowners tax exemption to 125000.

19 rows Georges property is a house located in the fictitious city of New Town.

Deducting Property Taxes H R Block

States Cut Taxes For Income Gas Property And Groceries Money

How To Avoid Estate Taxes With A Trust

Irs Announces Higher Estate And Gift Tax Limits For 2020

Data Shows Widening Gap Between Ada County S Commercial Residential Property Taxes Idaho Capital Sun

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

Property Tax Burden Shifting From Business To Residential Coeur D Alene Press

Idaho Legislature Introduces Property Tax Reduction Bill Idaho Capital Sun

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How To Avoid Estate Taxes With A Trust

Kentucky Quit Claim Deed Form Quites Quitclaim Deed Kentucky

/cloudfront-us-east-1.images.arcpublishing.com/gray/QUYAEQ7YA5DZDF533WMNOBOOKA.jpg)

Idaho Senate Passes Property Tax Reduction For Seniors

There S Got To Be A Better Solution Idaho S County Clerks Lament 2021 Property Tax Bill Idaho Capital Sun

What S The Most I Would Have To Repay The Irs Kff

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

Idaho Property Tax Assessments Will Likely Be Higher In 2021 Here S What You Need To Know Boise Regional Realtors